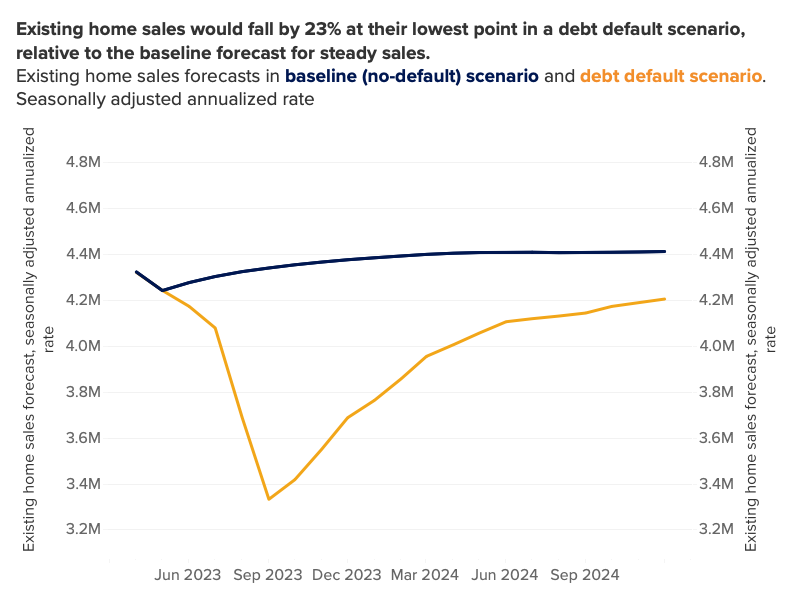

U.S. lawmakers are currently scrambling to reach an agreement on raising the debt ceiling. A recent report by Zillow explored the aftermath ramifications of the economic calamity on the U.S. housing market. According to the report, mortgage rates could increase to as much as 8.4% by September this year. The mortgage payment of a typical home would increase by 22% if the debt ceiling is not raised. Other implications include an increase in the unemployment rate, a decrease in home sales, and a drop in home values.

The U.S. could default on its loan by June. 1, if the debt ceiling is not raised. Janet Yellen warned of an economic calamity if Congress fails to raise the debt ceiling. President Joe Biden has canceled his foreign trips to meet with House Speaker Kevin McCarthy and other lawmakers to raise the borrowing limit. Zillow used scenarios published by Moody's Analytics during the potential debt ceiling crisis in 2021 to construct the forecast of a debt default. The scenarios provided the guidelines for predicting an increase in unemployment rates and 10-year Treasury yields. Zillow assumed the impact on 30-year mortgage rates as a linear projection from the Treasury yields. Zillow's senior economist, Jeff Tucker, noted in the report that the U.S. has never defaulted on its sovereign debt before and that it is difficult to find historical analogies to such occurrences. He added that the unlikely event would send the housing market into a deep freeze. In a letter to Yellen, leaders of the Treasury Borrowing Advisory Committee (TBAC) warned of "unthinkable" long-term implications from a debt default. The letter called for introducing an alternative system to enforce fiscal responsibility, such as requiring the limits to be raised simultaneously with appropriations or repealing the debt limit. The TBAC is an external committee that advises the Treasury Department on borrowing. The report predicts unemployment rates would increase sharply from the current level of 3.4% to a peak of 8.3% in October and then gradually begin to decline. This contradicts Zillow's baseline scenario, which expects unemployment to increase gradually from its current rate over the next 1.5 years and mortgage rates to decrease in the same timeframe. Mortgage rates surpassing 8% would cause a 23% decline in housing market activity. Home sales volume is projected to decrease from its seasonally adjusted annualized rate of 4.3 million in April 2023 to 3.3 million in September. However, the impact on home value in the event of a debt crisis is relatively moderate. Home values would decline around 1% from current values till next February and end up at today's value by the end of next year. In the no-default scenario, home values are expected to increase by 6.5% by December 2024. |